In this article I want to talk about something not often discussed within the developer community: financial investments. Developers benefited from higher than average salary, yet many are oblivious to the concept of financial investments. If you are already a financially knowledgeable developer, then kudos to you, this article will be targeted towards young, financially challenged developers with:

- Dwindling bank accounts, even with their above national average salaries.

- Okay to good money saved up, but not sure how to best make use of them.

I’m not a rich person, nor am I a hedge fund manager, I’m just a frugal developer who hustled his whole life to build up some extra money and discovered a way to get around 8-10% return on investments year to year. The tips I’m going to share are all based on my person experience, so I hope to give you a starting point to do your own research and for you to make sound decisions about your future finances.

Crash Course On Investments

I like to classify financial investments into three categories: passive, active and super active.

- Passive: Passive Funds are funds that are well diversified, it usually contains thousands of stocks of good and bad companies, some will contain bonds as well. Your retirement fund are usually part of those funds (example: Vanguard Portfolio). The benefits of passive funds is that you are investing in the market itself, meaning your investments are well diversified across hundreds of companies so the probability of losing your money is very low (you’ll only go broke when all thousands of companies go bankrupt). You will earn money from your investment little by little when the companies you invest in grow over time . If the market does well, so will your earnings, and over time the money will add up quickly due to compound earning (the money you earn are re-invested back to the market). This is the recommended way to invest if you like safety and guaranteed growth. I recommend apps like Betterment to manage your passive fund.

- Active: Active Funds are funds consist of smaller number of stocks, individual stocks you buy with your hard earned money. This method is a bit more risky, because you are not as diversified as a passive fund, and the stocks you pick can behave erratically and most importantly, YOU are the one who do the picking. With more risk, comes more reward because you now have more control over how much percentage of your money to go in to which stock. For example, you use Amazon and are a big fan of the company and you believe the company will do well, consider the hypothetical scenario when you bought 50 shares of amazon at $245.74 each for a total of $12,287 on April 24, 2012, fast forward to today, each share of Amazon costs $835.77, your 50 shares of amazon is now worth $41,788.50, you made a gain of $29,591, which more than tripled your initial investment, try to beat that with a savings account. Of course nobody can tell the future, so you’ll really have to research each company well before you decide to put the money in.

- Super Active: I DO NOT recommend you do anything I’m about to say if you are just starting out, because this has the potential to make you lose lots of money in a short amount of time. Super active investment refers to making big short term plays by monitoring short term patterns, timing the market with events around companies or country and bet on whether something will go up or down. Things like Options, Futures, Forex currency trading all fall into this category. Most people lose money if they invest this way, but of those who succeeds, they get rewarded handsomely. If you have some money to burn and would like to see fast results, then this is for you.

Tools

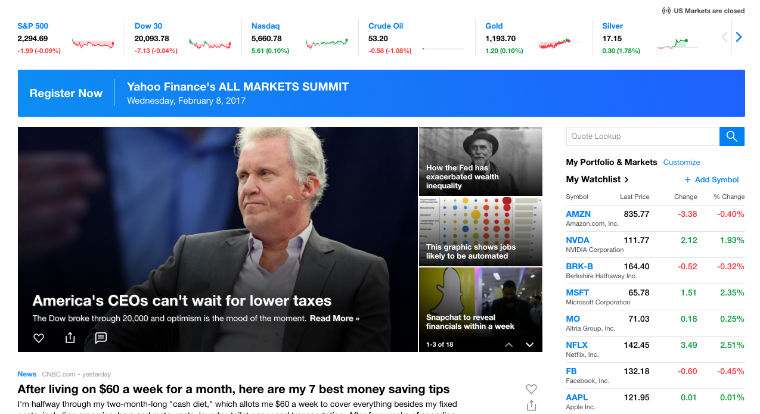

Yahoo! Finance

With all the negativity around Yahoo! lately, I highly recommend their Yahoo! Finance website, it’s one of the most informative site out there for investors, you can look up stock quotes, and get latest news stories about a particular company right at your finger tips, I use it to get extremely insightful real time financial data about companies I invest in so I can make better informed decisions.

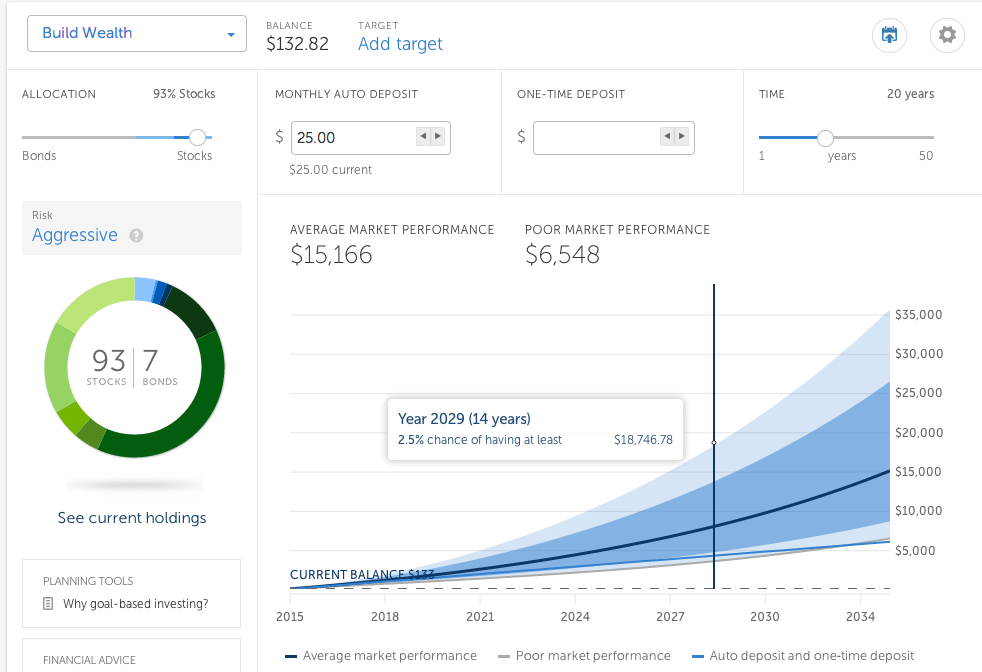

Betterment

I use Betterment to passively invest in ETFs or index funds. It is extremely easy to use and it’s literately set it and forget it. All you have to do is to download the app for iOS or Android, set up a goal, risk ratio (allocate percentages of your fund into a mix of stocks and bonds). For example, if you Invest $60,000 in the fund with a risk of 80% stock and 20% bonds, then within 20 years, it will be projected to become $650,000 based on results delivered by Betterment investment algorithms.

Betterment can set up monthly auto deposit from your bank account, and if the market doesn’t perform than calculated and is off track, it will ask you to adjust your monthly deposit into the fund. A really cool feature from Betterment is the “Smart Deposit” feature, which sets a threshold on your bank account, and automatically deposit any money in excess of that threshold, so let’s say you have a threshold of $10,000 in your bank account, if someone transfers you $5,000, that $5,000 will automatically be deposited into Betterment to your index fund.

Sign up with Betterment today to learn more and start saving for your future.

(disclosure: this is an affiliate link)

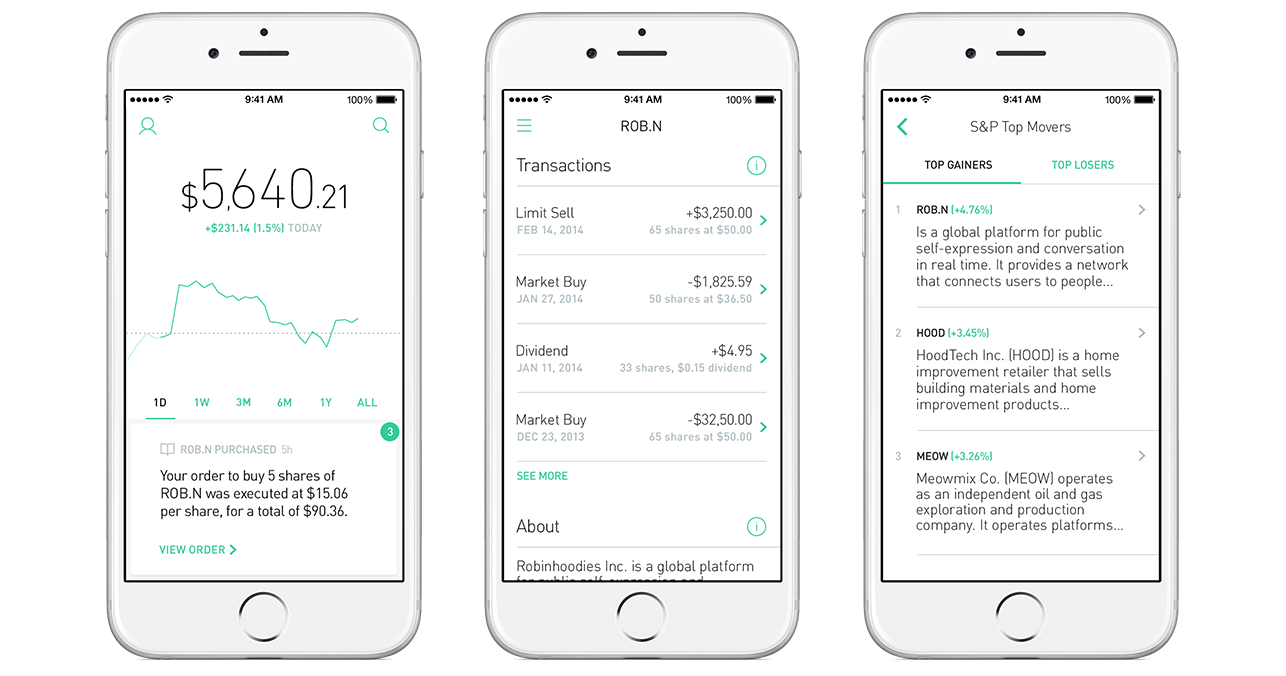

Robinhood

I use Robinhood for active investments. Robinhood allows me to buy/sell stocks at NO COST! This is a huge deal because usually you pay around $7 to make a trade with a brokerage firm. Robinhood has everything you need to get started in an awesome app for iOS and Android. I set up a list of company stocks I like and watch them closely daily. Whenever I feel like a good time to buy/sell stocks I would use Robinhood to make the trade. There’s really no catch, because Robinhood uses the fund you deposit into their system to passively earn money from them. Once you’re ready for day trade, Robinhood offers premium plan called Gold to give you faster/bigger deposits and unlimited day trades once you hit $25,000 balance.

Sign up with Robinhood to make free stock trades today and you will receive a random stock for FREE

StockYasuo

StockYasuo is a tool I developed and actively worked on to help you manage your portfolio, think of it as a lightning fast version of Yahoo News, it can quickly get you the information you want about stocks and news about your portfolio all in one place. Check it out here: http://www.penta-code.com/tools/stockyasuo/

Tips & Strategies

I’ve been doing this for over 2 years now and I have an average ROI of 8-10% on my investments year on year. Which isn’t that bad for a non-professional, it definitely beats putting money in the bank which sometimes can even lose money due to inflation. I’ve compiled a list of tips that I’ve found helpful for me, but take it with a grain of salt and do your own research:

- I’ve been a frugal person all my life, I don’t really get satisfaction from materialistic things, and as an analytical person, I evaluate every purchase decision and weigh in on what value it brings to my life, this does not mean being cheap, it simply means being aware of your spendings and make smart decisions about whether to buy something or not. Impulse buying is something that’s unavoidable and I’ve done it a few times, that is ok as long as you don’t make it a daily or weekly occurrence. Take a few moment to compare prices across multiple outlets and use coupons, promo codes, look for sales on websites like SlickDeals or eBay to get great deals on things that would otherwise cost you much more. The best thing you can spend your money on is your love ones and friends, spend money on experiences, not things.

- Set aside enough money in your savings account that can last you up to a year. This is a good bankroll management rule for rainy day. The rest you should put in investments.

- Become financially educated, spend your time educating yourself about the world of finance. The U.S. education system didn’t do a good job for me when I grew up, I would think all this finance mumbo jumbo are just for rich people from Wall Street. Remember knowledge is power, and to beat the system you need to know the system.

- Invest NOW, time = money, if there’s one thing I would tell my 13 year old self is to WORK MY ASS OFF (babysit, cut lawns, sell lemonade, HUSTLE) and put EVERY SINGLE PENNY I earned into a passive fund. The 13 year old me have almost 0 risk because I was living with my parents and have no living expenses. That money will become life changing by the time I am in my mid to late 20s.

- Use a stock market simulator to play around first. Investopedia has an awesome simulator where they give you a virtual $100k balance to trade, use it to practice until you’re ready to put up some real money.

- Do not be an emotional trader. When you’re doing active investing, try to think long term. It’s very tempting to sell certain stocks when it dips, most people who does that will never succeed, because you’ll be timing the market which has a 90% failure rate even for PROFESSIONAL traders. I do the opposite, I put more money in for a stock when it dips because I can buy it on a discount, generally if I am already invested in a company that I did plenty of research on and it dips, then I will buy more of it.

- Don’t invest around hype. You should invest as if you own the company. This is a tip from Warren Buffet, you should treat each share you buy as if the company is your own, you should know as much about the company as possible before you commit money to it. There will be times when many people rush to buy a random company stock because it’s “hot” or “everyone’s buying it”, you should only do it if you know about that company and believe it’s future is bright, otherwise keep your money for other opportunities.

- Max out your retirement fund. Unless you’re a freelance developer, chances are your company offer retirement funds, my number one advice is to contribute to the maximum allowed every month, and if your company provides matching contribution, then it’s even better. This money will be taken out of your paycheck every month and offers tax benefits. You HAVE to NOT think about this every month just let it happen, because after a few years, that money will grow and before you know it, you’re that much closer to being a millionaire.

- Invest in Gold and Silver as a hedge for the future. Gold and Silver usually move in the opposite direction of the strength of U.S. Dollars. I would set aside some fund to buy Gold and Silver for the event of total collapse of the U.S. Dollar, which isn’t likely to happen but if anything the 1920’s Great Depression and the recent 2008 Financial Crisis have taught us, it can happen. Usually when events like that happens, the value of Gold and Silver goes straight up.

- Don’t go into super active trading until you’re ready. It’s true you can make a ton of money from volatility from trading options, futures or forex, it also comes with huge risks, so you should educate yourself and play around before you try it.

- If you don’t want to spend time on what I mentioned above, pay a fund manager to manage your money, a good fund manager can give you a good return compare to doing it yourself. The down side is you’ll have to pay them a cut.

I hope this article provided you some useful insights on how I invest as a developer. I would like to see more people become financially aware and handle their money better. Let me know what you think and if it has helped you in the comments below.

If you enjoyed this tutorial, make sure to subscribe to our Youtube Channel and follow us on Twitter @pentacodevids for latest updates!